Institutional investors have long been considered a key ingredient in the recipe for bitcoin’s mass adoption. However, they are also considered the least likely to gamble on a product as unpredictable as cryptocurrency. According to popular belief, hedge and pension funds would hold back from crypto investment products, until the volatility notoriously associated with virtual currencies mellowed.

Oddly enough, these investors came to crypto right as volatility began to increase.

Between Black and White… Shades of Grayscale

As Crypto Briefing reported last month, Grayscale Investments reported a 42 percent increase in capital flows into its digital asset investment products – almost all into its bitcoin fund – in the first quarter of the year.

The investment company recorded a positive quarter for the first time since the end of 2017. The numbers remain tiny, at $42 million in inflows for the three months, up from around $30 million in the previous quarter. Crucially, however, hedge funds accounted for more than half of those inflows, pouring in $24 million compared to a mere $1 million in Q4 2018.

Meanwhile, in April the CME Group recorded all-time high trading volumes in its bitcoin futures product, as Bloomberg reported. That record was smashed again in May, with average daily volume up 27 percent from April levels. The bitcoin futures were first launched in 2017.

Institutional interest is clearly on the rise, suggesting the much-feared volatility must have dissipated, right?

Wrong.

Bitcoin Volatility Turned Sharply Eight Months Ago

Bitcoin volatility spiked sharply last November after a period of relative calm. According to data from Bitvol.info, at the end of November last year, as prices plunged following the contentious Bitcoin Cash fork.

Daily BTC volatility against the USD shot up from a range hovering between one and 2.5 percent to levels ranging from around two-and-a-half to five percent. It only briefly dipped below two percent. At its peak, on December 18, volatility hit 5.85 percent.

Given the corresponding increase in institutional interest, perhaps these investors aren’t quite as scared of volatility as originally believed.

Bitvol Bitcoin Volatility Index

According to Bitvol, the Bitcoin Volatility Index measures:

“… how much the price of an asset varies over time. Volatility refers to the amount of uncertainty or risk about the size of changes in a financial asset’s value. A higher volatility means that the price of the asset can change dramatically over a short time period in either direction. A lower volatility means that a financial asset’s value does not fluctuate dramatically, but changes in value at a steady pace over a period of time.”

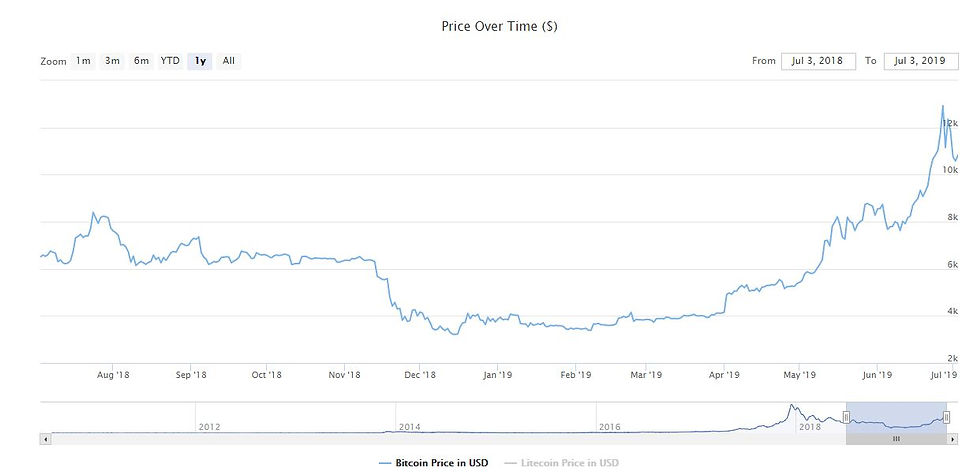

Rising volatility has coincided with a soaring price, though with a lag. As volatility began to rise on November 14, the price of bitcoin fell from around $6,000 to plateau between $3,500 to $4,000 from December to the end of March. That point – the end of March – marked a brief but precipitous dip in volatility and the beginning of a sustained rise in both price and volatility levels.

Bitvol bitcoin price

Institutional Investors and Volatility… Walking Hand In Hand

To the extent that bitcoin’s price surge drove some of the recent volatility, institutional investors may have inadvertently driven the fluctuating prices they had always been so desperate to avoid. The surging demand for bitcoin at the institutional level after a long period of dampened enthusiasm played some part in driving up prices so quickly… and creating volatility.

Interest among institutional investors in bitcoin is still tiny in comparison to that in more established asset classes. It might be difficult for hedge and pension funds and investment banks to enter the emerging asset class without causing bubbles and exacerbating its historical propensity to being volatile.

Even with the benefit of OTC trading options, the demand pressure these investors would put on bitcoin prices could easily generate further market upheaval.

Upheaval of a positive kind, that is.

Comments